- Help your client see and understand their net worth and risk profile based on their current position.

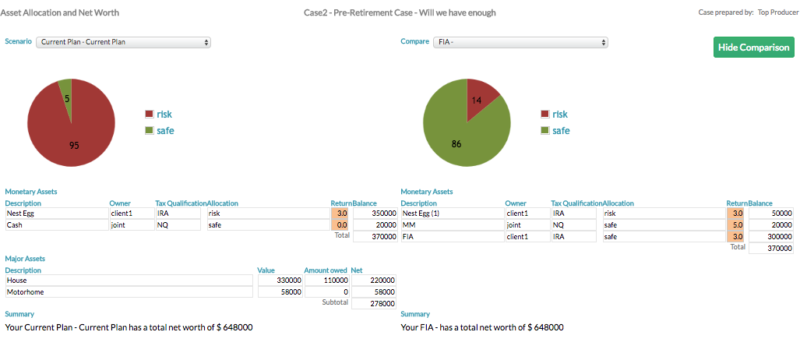

- Compare current risk profile with proposed asset allocation to manage risk aversion.

- Provide graphic demonstration of current and proposed strategy.

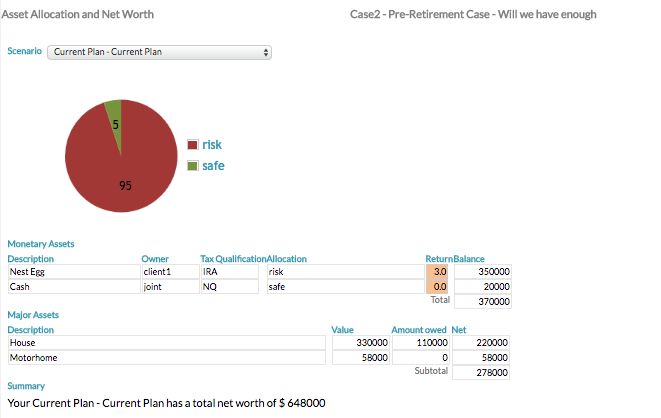

When you document your clients assets using the discovery process on the Client Information Page, SIPS RPS Software automatically creates an Asset Allocation and Networth graphic report. This allows you to easily document your clients current net worth and financial position as well as their current “risk” profile.

The graphic illustration of safe or conservative options vs options with more risk attached makes these concepts easy for your client to understand.